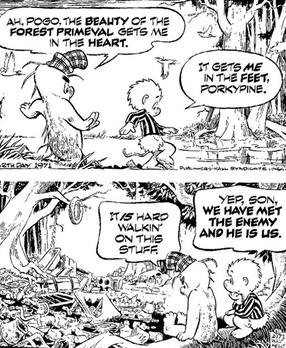

How many times will this simple observation be a revelation? Uttered humbly and powerfully in 1971 by one of the most influential leaders of our time—the cartoon strip character Pogo—this statement has never been truer than it is today. If you are angry about the capital markets mess we find ourselves in, you need travel no farther than your own bathroom mirror to pick a bone with the protagonist.

Those of us who are reaching the age at which we would like not to work as hard as we did the last thirty odd years, are eyeing the door marked “Retirement”. We realized years ago that we couldn’t count on Social Security being our only source of income, even if the benefits owed to us really materialized. But Social Security was never intended as a total answer to income requirements in our “golden” years. The need for alternative income sources is exponentially more intense than we anticipated, however, because our government is borrowing from this trust fund faster than you can say “IOU”. And the demographic segment of the working population who will be paying into the system for you and me is not as voluminous as necessary to keep the whole funding engine afloat. Check out the information on the General Accounting Office website, if you want an icy shower to wake you up.

To address the need for preparing for retirement, recognizing the declining viability of defined benefit pension plans, we were given the opportunity to invest our own dollars, tax deferred, into long-term bets that would hopefully yield decent cash flow when we hung up our guns. That opportunity came in the form of 401(k) plans, referring to the section in the Internal Revenue Code that prescribed the methods allowable under the tax law. This tax provision further expanded the idea of Individual Retirement Accounts (IRA’s) established by the Employee Retirement Income Security Act of 1974. Some cynically say this tax legislation was designed to accelerate the value of existing stocks on public markets. Lots of new customers were created in 1978, the birth year of section 401(k). If demand goes up, so do stock prices. Loss of confidence in equities periodically shifts investment appetites. Competing opportunities tempted the 401(k) and IRA dollars to other vehicles. Alternatives included real estate, commodities, the futures markets, etc. But the goal has been consistent no matter what the investment vehicle: double digit annual returns. Lots of money, many billions each month, has been pouring into these investment vehicles that are tax deferred. The managers who receive the money (mutual funds, life insurance companies, stock brokerages, etc.) have been judged on how well they grow the assets under their care. So they look for aggressive growth opportunities, in order to satisfy you and me, their customers. And institutional investors make up about two thirds of the activity on Wall Street.

These institutional investors placed bets on the real estate mortgage market, because the securitized debt obligations were promising, you guessed it, double-digit returns. Just like we wanted. Now that the over-heated, unjustifiably inflated mortgage markets have “corrected”, the hunt is still on for those high returns. So institutional investors changed their focus from mortgages to commodities, such as oil, gas, steel, gold, crops, etc. This has pushed up the value of those assets, due to the higher demand.

So the next time you pay almost $5.00 a gallon for gas, and about the same for a gallon of milk and a loaf of bread, go straight home, look in the mirror and say to yourself, “If your personal debt wasn’t so high, and you didn’t require so much money for retirement, you wouldn’t be paying this much for fuel and food. If you hadn’t elected government representatives who raided the Social Security cookie jar and pushed up national debt to equal GDP, you wouldn’t need to be worried about receiving your benefits as planned. The deferred compensation you allowed others to manage on your behalf could have been less aggressively invested, in lower-risk assets.”

As usual, when we truly analyze who is causing us so much grief, we don’t have to look very far.